Monthly recurring revenue, or MRR, is the lifeblood of any SaaS business. If your company is charging clients on a monthly basis, signing up new customers and keeping them on board has an incredible impact on your revenue and growth rate.

The only problem is that accurately calculating MRR can be notoriously challenging. As customers join and cancel, projecting the monthly recurring revenue for two, three, or six months into the future can be a serious issue, even for the most data-focused businesses.

Add scheduled upgrades, downgrades, and discounts into the picture, and staying on top of your projected MRR can become a significant time cost for your business.

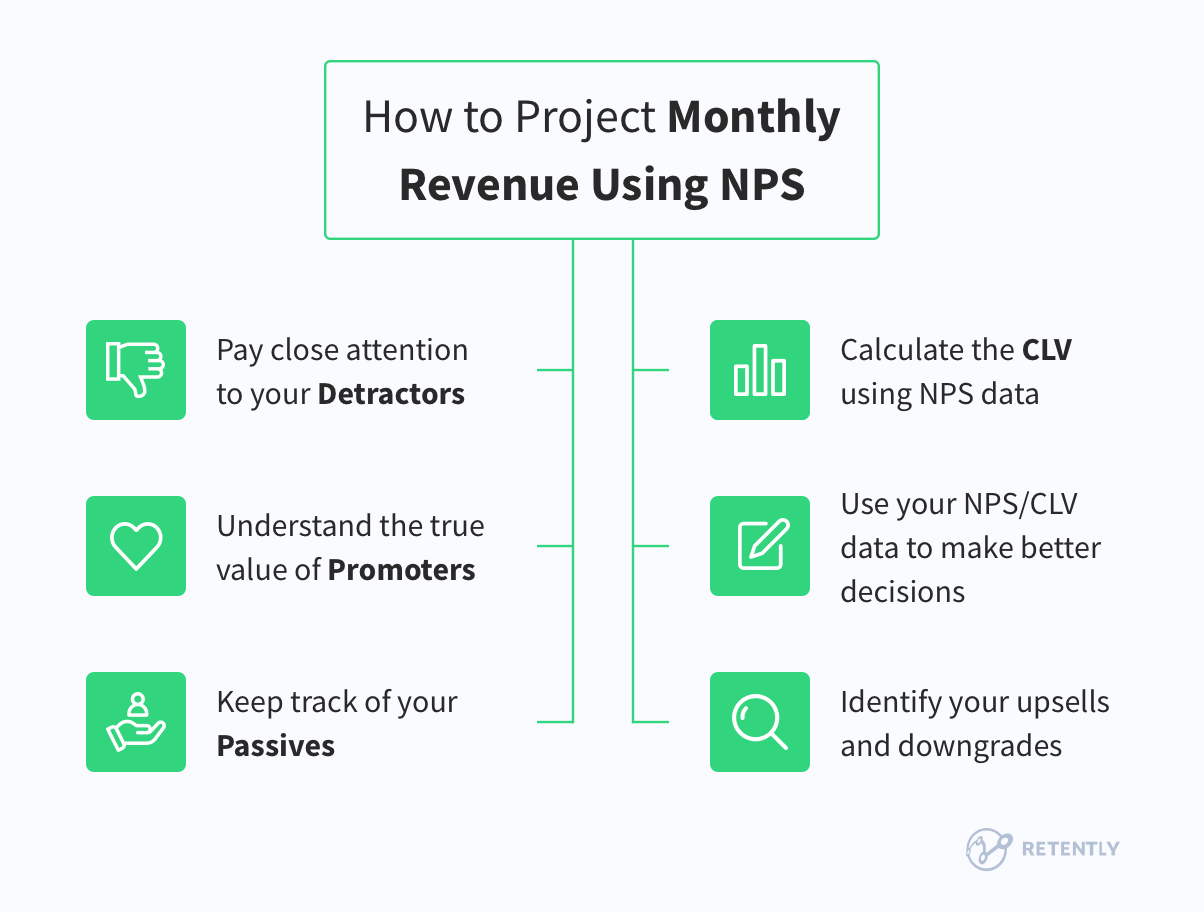

Luckily, you can accurately calculate and project monthly recurring revenue trends using your NPS data.

In this post, we’ll explain how you can do it, as well as how you can use this data to adjust your business to increase MRR, improve retention and generate more revenue.

1. Pay close attention to your Detractors

If a customer is a Detractor, there’s a serious chance that they’ll cancel their subscription either in the next billing period or in the near future.

If a customer is at the lower end of the Detractor range (for example, a score of zero or one out of 10), it’s almost certain that they’ll give up on your product and cancel before the next billing period.

This makes it important for you to pay close attention to your Detractors when calculating your company’s monthly recurring revenue trajectory.

If you notice that the number of Detractors is increasing, there’s a high risk that your SaaS company could backpedal when it comes to monthly revenue growth.

Remember that Detractors can harm your MRR in several ways. They can cancel, costing lost revenue and negative publicity in the form of blog and forum posts, potentially hurting your MRR even more in the long term.

As the percentage of Detractors increases, relative to the share of Passives and Promoters, you might need to revise your MRR downwards to match the cancellations and impact on growth the Detractors can cause.

It’s easy to focus on customer acquisition, all while ignoring the severe risk posed by Detractors not only to your churn rate but to your ability to acquire new customers in the future.

Pay close attention to your Detractors, even if they don’t significantly affect your MRR at that particular moment. It only takes a small amount of negative publicity to hurt your brand, slowing customer acquisition and your business growth. Try these effective techniques to help you turn Detractors into Promoters.

2. Understand the true value of Promoters

Many businesses make the mistake of viewing Promoters only as loyal customers — people who are unlikely to cancel their subscriptions and stay customers for years into the future.

The reality is that Promoters aren’t only loyal — they can also be a valuable source of customer referrals that help your business build its monthly recurring revenue without much advertising, promotion, or other marketing.

This makes it essential for your business to measure the true value of Promoters both in terms of the revenue they directly generate and the customers they bring in as referrals.

The easiest way to do this is by implementing a referral program. Airbnb, which famously grew through a generous customer referral scheme, used its NPS data to correlate referral revenue with the likelihood to recommend (LTR) scores it received in NPS surveys.

Airbnb’s data showed that users giving a rating of 10 on the company’s NPS survey were 4% more likely to refer customers than Detractors — a small but significant increase in the likelihood that has a measurable impact on revenue.

This data allowed Airbnb to calculate the value of a Promoter more accurately, and gain a much deeper understanding of how customer satisfaction plays a role in organic growth and long-term MRR.

3. Keep track of your Passives

While you may think Detractors and Promoters are the most influential groups in the Net Promoter System because the former are more likely to churn and the latter more likely to spread the word about you, Passives shouldn’t be ignored either.

Passives are those customers who use your product for the time being because it satisfies some of their requirements, but when they get hold of a more compelling alternative, they will leave immediately. Basically, they are not that far from Detractors when it comes to churn rate, so keeping track of their number can help predict MRR more accurately.

An increasing number of Passives is a sign that something is not working properly or there is poor engagement with your product, meaning churn will inevitably follow if proper action is not taken. In many cases, one little mistake or inconsistency is enough for a Passive customer to become a Detractor, which will ultimately negatively impact your numbers.

Still, there are multiple ways to turn Passives into Promoters: by taking appropriate steps to tackle arising issues you will be able to boost customer retention and increase your MRR.

Generally, you cannot entirely avoid churn, but by emphasizing and constantly increasing the value of your product, you can persuade at-risk customers to change their minds. All you need is a great product that lives up to the ever-changing customer needs, proactive customer service that will help your audience achieve their goals, and consistent communication that will keep them engaged.

4. Identify your upsells and downgrades

The recurring nature of customer payment enables a company’s future performance to be more predictable, thus reducing potential risks. NPS is a reliable metric when it comes to predicting customer behavior, hence facilitating the efficient projection of the MRR.

While many focus on increasing their revenue only by bringing in more customers, identifying and targeting existing customers who rely on your product and have more buying potential can result in even bigger wins. By individually approaching this customer segment, looking into their NPS feedback and testing different price points, you can create a scalable revenue model and generate great insights into the performance of your SaaS.

In the Net Promoter System, Promoters are clearly those people who will happily renew or upgrade the subscription. You can easily cross-sell and upsell them, thus increasing your MRR, so exploring these opportunities will prove beneficial.

Detractors, on the other hand, have a high likelihood of churning in the near future, negatively impacting your MRR. Just like Passives, they hold on to your product because they have no better options at the moment, and will use every opportunity to downgrade, get a discount, or get back to the free version (if you have it). Of course, that’s unless you dig deep into their behavior to find individual approaches that will bring forward your product’s value to these customer categories; or maybe suggest a down-sell yourself to showcase that serving their goals is more important than selling a product they do not need.

If you have an expansion strategy in place or use down-sells to improve your bottom line, considering a customer’s revenue potential when projecting your MRR is worth the mention. Any shifts in the number of Promoters, Passives and Detractors predict potential changes in future revenue. Hence, by monitoring the NPS feedback, keeping a pulse on product usage and analyzing the behavior trends, you can easily shape accurate growth forecasts.

5. Calculate the lifetime value using NPS data

Finally, the most effective way to use Net Promoter Score to calculate your company’s MRR is to correlate NPS likelihood to recommend scores with a specific customer value.

Like most CLV-related metrics, this data can take time to calculate. You’ll need a large audience and a big enough sample to calculate customer value without statistical insignificance getting in the way of accuracy.

Once you have thousands of likelihood to recommend customer ratings, you can begin calculating the average lifetime value of a Detractor, Passive and Promoter.

Doing this is relatively simple. In fact, you can use a simple LTV equation to calculate how much revenue you earn from each customer. Since you’re calculating by NPS category, you just need to sort your customers into Detractor, Passive or Promoter groups before using the equation.

If you have referral data for each customer type, add it to each category’s total revenue before calculating CLV, as it can be significant for Passives and Promoters.

With specific CLV data for each group, you’ll be able to quantify precisely how much a Detractor, Passive or Promoter is worth to you. You may be surprised by the difference between one type of customer and another, especially between Detractors and Promoters.

6. Use your NPS/CLV data to make better decisions

When you quantify the difference in value between a Promoter and a Detractor, it becomes far easier to see why customer satisfaction matters.

Most of the time, Detractors are worth far less than Promoters in long-term revenue. In some cases, Detractors can have a negative revenue figure for your business, increasing the gap between a happy and unhappy customer.

With your NPS/CLV data at hand, you can make informed decisions to reduce the rate of customers that become Detractors over time. You can implement tactics to increase CLV or use customer service hacks to turn Passives into Promoters.

By reusing the LTV equations above 6 or 12 months later, you can even quantify how big of an impact these decisions have in real revenue terms.

Start using NPS to spot MRR trends as they happen

If you’re new to Net Promoter Score, there’s no need to dive into the world of complex software development to get started. Retently makes surveying your customers, responding to feedback, and calculating your Net Promoter Score an absolute breeze.

But don’t take our word for it – create your Retently account now and put it to work.

Greg Raileanu

Greg Raileanu

Alex Bitca

Alex Bitca