Table of Contents

Here’s an interesting question for B2B companies that use Net Promoter Score to get feedback from their clients:

Scenario: You run a B2B company that sells software. Who should you survey? Should you ask your key contact to complete your NPS survey, or should you send it to every user who engages with your product?

Based on our reading, it seems that the majority of Net Promoter Score users believe it’s best to survey your key contact. However, we think there’s a case to be made for both options, plus the third option: sending your NPS survey to the end user and your key contact.

In this post, we’ll look at some of the advantages and disadvantages of both approaches to help you get the most from your use of Net Promoter Score.

Key Takeaways

- Surveying all users provides a broad range of insights, identifying trends and issues for better product improvement.

- End users offer direct, detailed feedback, highlighting specific technical issues and real user experiences.

- Key contacts, who make purchase decisions, provide critical feedback for retention and revenue forecasting.

- Segmenting surveys for both end users and key contacts ensures comprehensive insights for product optimization and customer retention.

More Data Equals More Insights and Better Feedback

First, let’s cover some of the advantages of emailing your Net Promoter Score survey to every person who uses your product.

One of the biggest advantages of this approach is the sheer quantity of feedback you can get over time. If you sell software to B2B companies with hundreds of users, you can potentially generate tens or hundreds of responses from each survey.

This makes it easier for you to spot common trends in feedback for your team to look into. It’s also a great way to discover which issues affect your Net Promoter Score and stand out to the most end users.

Since you can receive hundreds of different responses from people within a single business or organization, this approach is also an excellent way to view the diversity of opinion that can happen in one workplace.

With some simple analysis, you might find that engineers love your software, but salespeople aren’t so excited. You might realize that lower-level employees love using it, while executives are less impressed.

This scale and diversity of feedback can make it easier to spot problems and opportunities in your product, helping you prioritize changes and make improvements.

For example, by gathering data from your product’s end users, you can segment results based on their roles and specific challenges. This diverse feedback helps pinpoint goals more accurately and reveals niche use cases that could lead to new market opportunities.

Eventually, comparing survey results from product users across different organizations allows you to correlate segmented data effectively. This helps identify common issues and develop a focused strategy, enhancing your product’s value and increasing its demand.

Real User Data is Often the Most Valuable

Another advantage of surveying end users rather than key contacts is the quality and depth of their feedback.

While key contacts might manage people who use your software, they rarely have the level of hands-on experience that an end user has. This can mean their feedback is second-hand — a summary of likes and dislikes based on what hands-on users have reported.

Key contacts can also have a slight bias in their feedback. For example, if your contact is also the person who decided to use your software in the first place, there’s a chance that they could take an overly positive view of your product to justify their own decision.

Real users, on the other hand, are usually direct and critical of your software. They tend to point out bugs when they encounter them and provide brutally honest feedback about features that don’t work as they should.

If your company sells a technical product to an equally technical audience — for example, CAD software to industrial designers — they can provide detailed technical feedback that sales, management, and marketing contacts can’t.

All of this affects the value of the feedback you receive from each NPS survey. As well as giving you a greater quantity of feedback, actual users can also have a noticeable effect on the quality of feedback you receive from every Net Promoter Score survey you send.

Ultimately, Users Don’t Make Buying Decisions

The downside to surveying users is simple: while users might provide the most useful feedback for your engineers, designers, and customer satisfaction staff, they ultimately aren’t responsible for the decision to continue using your product.

That responsibility belongs to your key contacts, and there’s no guarantee that their feedback is the same as your product’s users.

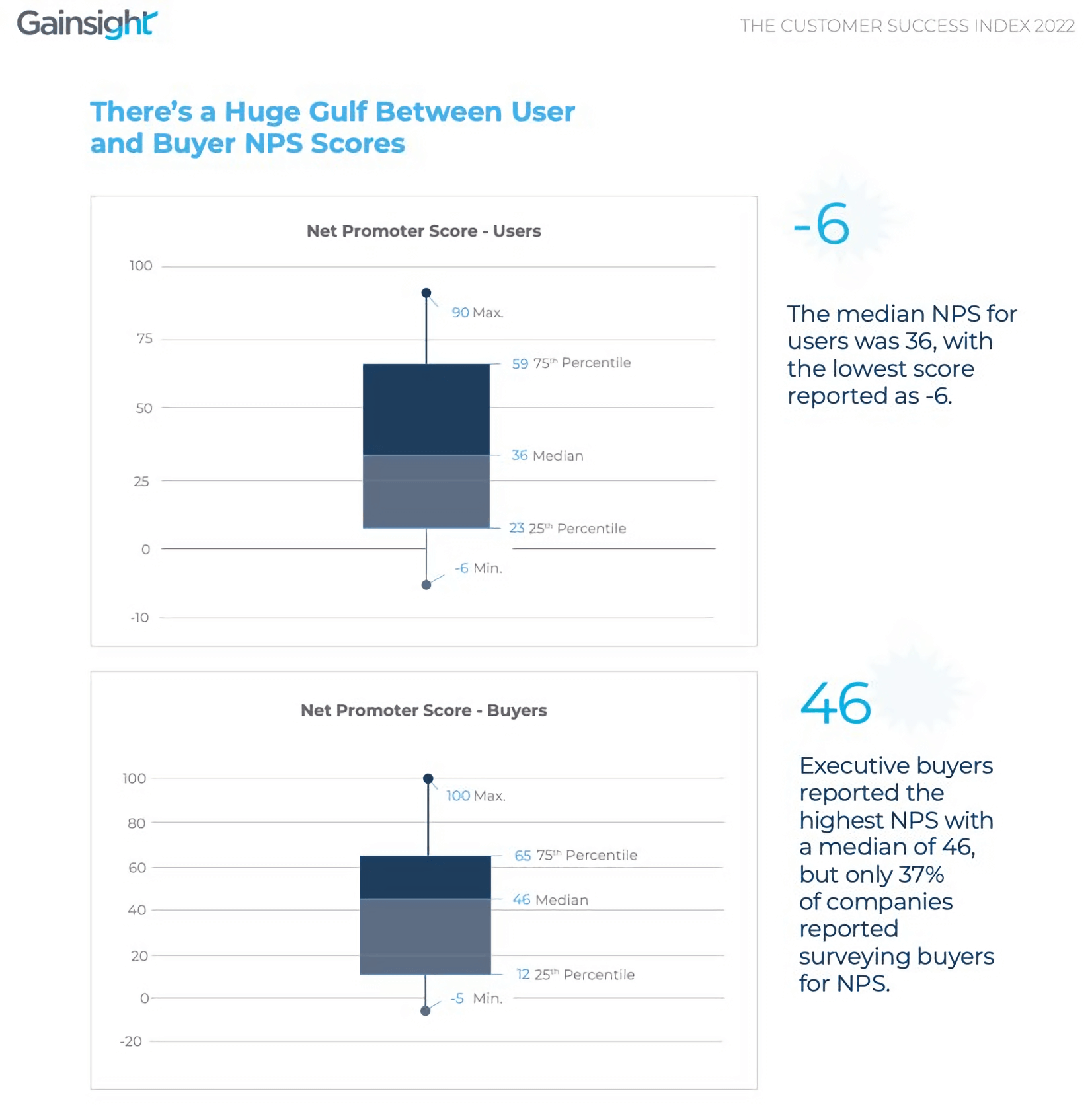

Many companies notice a significant difference between the Net Promoter Scores they get from key contacts and the NPS data they get from end users. It’s far from uncommon for one group to consist of Detractors or Passives while the other group consists of Promoters.

This can occur for a variety of reasons. Sometimes, your product makes life easier for managers and other high-level staff, all while frustrating its users. Sometimes the opposite occurs, with end users viewing your product as essential and managers being largely unaware of its importance.

Gainsight’s Customer Success Index 2022 confirms the significant gap in NPS between users (median of 36) and executive buyers or key decision-makers (average NPS of 46). The data suggests that buyers, who are responsible for purchasing the software but may not necessarily use it on a daily basis, are more satisfied with the product than the actual users who interact with the tool regularly.

One valid point to keep in mind is that NPS data from your key contacts is more valuable from a retention perspective than NPS data from end users.

After all, it’s your key contacts that will decide whether or not to continue using your product, not the people that use it on a daily basis.

This means that if you use Net Promoter Score for retention and revenue forecasting purposes, you should focus on surveying your key contacts. If you use it to improve your product with real user feedback, you should focus on end users.

Why Not Segment Your Audience and Survey Everyone?

Luckily, there’s a third option: surveying everyone. By segmenting your audience into daily users and key contacts, you can survey everyone and gain valuable feedback on your product from a buyer’s and user’s perspective.

This strategy lets you keep track of two things at once: how your product is performing from the perspective of paying customers and how it’s really performing from people who interact with it frequently.

Using Net Promoter Score this way means you can optimize retention and predict your monthly recurring revenue based on key contact NPS data, all while using the actionable feedback you get from your end users to make real improvements and optimizations to your product.

Send Your First Net Promoter Score Survey With Retently

We’ve designed Retently from the ground up to make surveying your customers and calculating your Net Promoter Score simple. Learn more about how your business can use NPS, sign up for your free trial and start surveying your customers now.

Alex Bitca

Alex Bitca

Greg Raileanu

Greg Raileanu