AWe’ve previously covered the common characteristics of companies with high Net Promoter Score and boiled their success down to three qualities:

- Simple, reliable products

- Great customer service

- Unique products and offers

You can learn a lot about improving retention, customer lifetime value and increasing your Net Promoter Score® by imitating the tactics implemented by the world’s most successful companies. Study the hacks used by brands like Apple, Amazon, and Netflix, and you’ll discover actionable tactics that can apply to your business.

You can also learn a surprising amount of tactics and strategies by studying the opposite end of the scale – the world’s least successful companies, from a churn perspective – to compare their common weaknesses and find out what makes their customers so unlikely to recommend them to their peers.

Since not all NPS® data is public, and most brands aren’t eager to publish their low Net Promoter Score, we’ve taken several steps to find reliable customer satisfaction data that we can use to compare brands:

- Whenever possible, we’ve sourced data from various NPS benchmarks to gain a picture of the general NPS range within an industry.

- In industries with a low overall NPS, we’ve looked at consumer complaint data to learn which brands are the least likely to retain customers and earn positive feedback.

- We’ve excluded industries with an extremely low average NPS, such as debt collection, as they’re unlikely to produce helpful insights for most startups and technology businesses.

Ready to start? Below, we’ve compared companies with low Net Promoter Scores relative to the averages for their industries to determine which characteristics have the most significant negative impact on customer satisfaction.

What Is a Low Net Promoter Score?

Net Promoter Score is a widely used metric that measures customer satisfaction and loyalty. It looks into customers’ likelihood to recommend a product/service to others, which is calculated by subtracting the percentage of Detractors (customers who are unhappy and at risk to churn) from the percentage of Promoters (customers who are satisfied and likely to recommend).

Simply put, a low NPS score means more Detractors than Promoters, suggesting customers are dissatisfied with a company’s overall performance. That can negatively impact customer retention and, as a result, business growth. The lowest possible NPS score is -100, implying every customer is a Detractor – an unlikely scenario.

A low Net Promoter Score also refers to a value below the NPS industry benchmarks. Some industries tend to have lower NPS scores than others, including cable and internet software & service, healthcare insurance, communications & media.

While the reasons may vary, there are some common behaviors that prompt a low NPS score. That’s exactly what we’ll pursue next.

Aggressive or Misleading Billing Practices

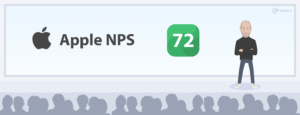

Apple, which markets its products using brand-focused advertising, topped the 2013 technology statistics with a Net Promoter score of 65 for iPad, 70 for iPhone and 76 for its range of laptops. What’s more, according to the available NPS Benchmarks, Apple did not give up the top spot maintaining an NPS score over 60 throughout these years.

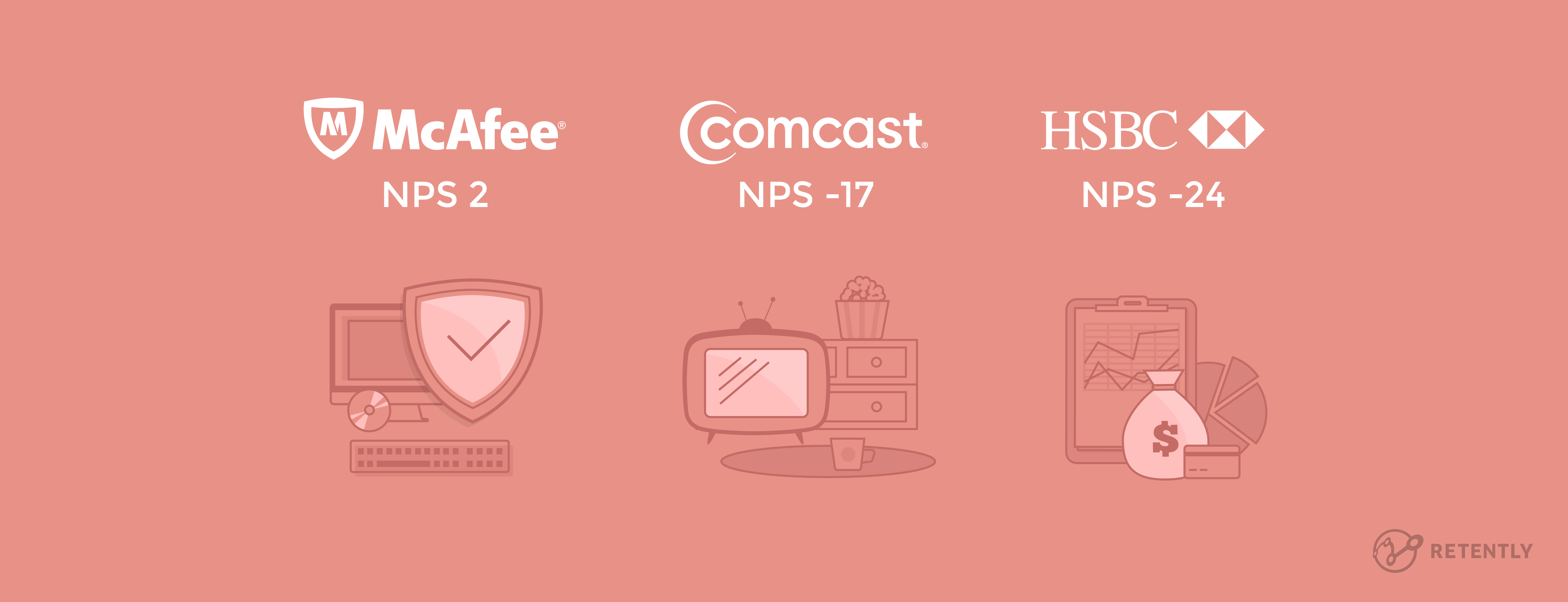

The antivirus software company McAfee is at the bottom of the technology industry, earning a Net Promoter Score of 2.

Other brands in antivirus software, such as Kaspersky, report relatively high NPS results, although they don’t provide exact statistics. From this data, we can determine that McAfee’s low NPS is likely a result of its specific practices instead of the overall negative sentiment in this product category.

Many complaints directed toward McAfee are common among companies with low Net Promoter Score. The most frequent one, dating back to 2010 and repeatedly reported over the last six years, involves automatically re-billing customers’ credit cards.

This example isn’t a statement about McAfee’s specific practices, as they’re far from uncommon in many industries. However, it’s clear that the businesses scoring lowest in the NPS survey also tend to use the most aggressive sales and billing techniques.

The lowest-ranked companies tend to use negative-option billing – a controversial practice that involves automatically providing goods and billing customers. After agreeing to a contract, often for a free sample or trial, customers are automatically billed until they opt out.

There’s nothing evil about negative option billing – in fact, many of the world’s most liked companies also use it. Netflix, which maintains an extremely high NPS, offers a free trial with an option for users to continue using a similar subscription-based billing model.

Businesses with great Net Promoter Scores tend to be transparent about their billing practices and make it clear when and how customers will be billed. Companies that rank near the bottom are the exact opposite – opaque and often deceptive about billing.

If your business depends on recurring billing – for example, a monthly SaaS subscription or an ongoing product delivery service – it’s essential to be transparent about how you’ll handle billing for your service. Get aggressive or deceptive, and there’s a good chance it will hurt your customer satisfaction.

Limited or Poor-Quality Support

Another common weakness among companies with low NPS scores is bad service. In a Temkin Group NPS Benchmark Survey, Comcast TV earned the lowest NPS both in its service category and overall – a score of -17. Four years in a row, the provider did not leave the negative end of the NPS scale.

Comcast’s customer service is among the lowest-rated in the United States. In fact, the brand’s service is so poorly rated by its customers that it’s become subject to senate hearings, in which the company presented a plan to improve its relations with clients.

In Comcast’s case, the customer service wasn’t just bad but outright disrespectful. In an effort to retain as many customers as possible, Comcast agents were trained to work as hard as they could to encourage customers to stay with the company when they asked to cancel.

There are two lessons here for businesses aiming to improve retention, increase customer satisfaction, and foster loyalty. First, poor service can and will hurt customer relationships.

The second is that taking a short-term approach to retention, as Comcast and other brands did by using aggressive customer retention tactics, will likely backfire. Comcast’s efforts probably kept some customers onboard but at the cost of many others who deserted the company for good.

When it comes to customer service, there is another important consideration to pinpoint. The Wells Fargo scandal is a vivid example of how poor service practices can result from a toxic working environment. The company’s aggressive sales goals and high pressure determined employees to open millions of fake accounts without customers’ knowledge. That led to irreparable reputation damage and a notable decrease in the company’s NPS score – a value of -3, to be exact.

Due to the unrealistic sales targets, as high as 8 to 20 products a day, employees felt forced to compromise their values and resort to deceptive practices to keep their jobs. As a result, many suffered from stress and anxiety, which negatively affected their ability to provide good customer service and further contributed to the overall decline in customer satisfaction.

Product Quality Issues

Sometimes the simplest reason behind a low NPS is this: the product just doesn’t work like it should.

No matter how good your support team is or how clever your branding sounds, if what you’re selling is buggy, fragile, or unreliable, customers will walk away.

One of the most visible examples here is Wish, the ecommerce platform once known for ultra-low prices and viral ad campaigns. It attracted millions of users with $1 deals, quirky listings, and attention-grabbing marketing, but product quality was a recurring problem behind the scenes. Customers often received items that looked nothing like the photos, arrived damaged, or never showed up at all.

It wasn’t just accidental. According to former employees, the company prioritized aggressive growth over quality, even running internal experiments using fake storefronts to see how many people would complain about orders that were never fulfilled. Complaints about unsafe or misleading products piled up, and search engines and app stores in France even delisted Wish due to product safety concerns. As customer trust dived, Wish’s monthly user base dropped from 101 million to just 27 million in one year, and its NPS reportedly fell to -13 – one of the lowest among ecommerce brands.

Even a great support team can’t make up for a product that consistently underperforms. When customers experience repeated breakdowns, frustrations stack up. They stop giving second chances and start spreading the word.

The takeaway? You can’t market your way out of a quality issue. Delivering a reliable product is the bare minimum if you want to build loyalty and drive positive word-of-mouth.

NPS Is Subject to Overall Trends in Customer Sentiment

In 2007, most customers were happy with their banks. Consumer-focused banks reported an average Net Promoter Score in the 30s, indicating positive sentiment and overall satisfaction with the industry.

Then the global financial crisis happened, and sentiment toward the entire financial services industry nosedived. The average NPS dropped from 40 to 22 over the course of two years, and from approximately 27 to just 11 for credit card providers.

These industries didn’t drastically change their customer service processes during this period, but the overall market trend produced a significant decline in customer sentiment that affected their Net Promoter Score.

Poor service or a bad product can hurt your NPS within your industry. However, every business – from technology to finance – is subject to public opinion. Many companies with low or declining Net Promoter Score combine a downward trend with a poor approach to service.

For example, satisfaction among finance industry customers has largely recovered since the global financial crisis. However, specific banks, that have been plagued with scandals, rank near or at the bottom of the NPS average for the industry.

HSBC, for example, earned a Net Promoter Score of -24 after a series of scandals, combined with record-setting customer service complaints, damaged the brand.

A great product combined with strong customer service is often enough to survive a downward trend in overall customer sentiment. However, a poor experience in a disliked industry can lead to a swift and significant reduction in a company’s Net Promoter Score.

Customer Experience Is Crucial

Offering a highly demanded product isn’t enough. It’s important to ensure people have a great experience while using it. And that’s something McDonald’s learned the hard way. Even though it’s one of the most recognizable brands in the world, the largest fast-food chain has a devastating negative NPS of -8 in the USA.

In 2013, McDonald’s recorded the longest waiting time at its drive-thrus. And the wait time is mainly influenced by the menu complexity. The chain started with 26 menu items in 1980, which increased to 121 in 2014. Over the next three years, the company would find itself at the negative end of the industry NPS benchmarks.

In comparison, McDonald’s’ direct competitor, KFC, isn’t doing quite great, but at least they have a positive NPS of 14, experiencing an upward trend over the years.

The best-performing fast-food chain in America is Pizza Hut with a Net Promoter Score of 78.

Net Promoter Score and Brand Awareness

A high score is inspiring and can be considered an important achievement. Yet, sometimes, the NPS score doesn’t actually matter, and it can be affected by factors unrelated to business performance.

A great example is Uber and Lyft. These two brands are almost identical in their service, and drivers often work for both companies. However, despite their obvious similarities, Uber managed to get a score of 37, while Lyft is way behind with an NPS of 9.

The difference can be explained by the fact that Uber has a more recognizable brand, since its name often appears in the press, and also covers a significantly larger part of the US and abroad. At the same time, Lyft only offers the service domestically.

Deliver as Advertised

The insurance industry is one of the most developed in the US, which also means that competition is very high and it’s crucial to retain your customers.

The direct correlation between satisfied customers and long-term revenue growth is undeniable. Some businesses, though, chose fast revenue over customer needs and got to the bottom of the NPS chart for their industry. That’s the case with CIGNA, a health and life insurance company with a score of -1.

The insurance company was affected by a long-lasting scandal regarding their refusal to satisfy disability claims by their customers. Since 2009, CIGNA has been monitored by relevant authority institutions.

In comparison, their competitor, GoMedigap, has an astounding score of 93. This proves that the issue is not with the insurance industry (as was the case with the banking sector in the US, mentioned above). The problem lies within CIGNA’s internal policies and its denial to provide the advertised product.

Yet, this is just one thread in a larger story – the hype trap – where big promises backfire.

Expectation Overload: The Hype Trap

You know the type. Bold claims on the homepage like “Next-level experience!”, “Unmatched reliability!”, or “World-class support!” And yet… the actual customer experience feels more like a rough beta than a finished product.

That’s exactly what happened with Peloton between 2021 and 2023. The brand promised a premium, seamless fitness journey – stylish hardware, top-tier instructors, and a tight-knit community. But many customers found themselves waiting weeks for deliveries, navigating frustrating hardware issues, or dealing with major product recalls. In 2023, Peloton recalled over 2 million bikes due to safety concerns, and complaints about slow support and unresolved problems piled up.

Their Net Promoter Score told the story. Once riding high with an NPS of 76 it dropped to 32 by the end of 2023.

And they’re not alone. Another example is WeWork, which launched with massive buzz and positioned itself as the future of work – sleek coworking spaces, vibrant communities, and flexible memberships. But as they scaled, the disconnect between promise and reality grew.

Customers encountered all kinds of frustrations: clunky booking systems, poor responsiveness, unresolved billing issues, and cancellation policies that felt intentionally difficult to navigate. Despite branding itself as flexible, WeWork required users to go through slow, uncoordinated customer support channels just to cancel a membership or fix a basic issue. It wasn’t uncommon for requests to go unanswered for days or weeks, often bouncing between chat, email, and phone without resolution.

Even worse, inconsistent policies across locations and a general lack of transparency left customers feeling misled – charged for services they didn’t use, or stuck in rigid contracts despite operational disruptions. The perception shifted quickly: what was marketed as an innovative, user-first company now felt like an old-school landlord in a modern costume.

In both cases, the problem wasn’t just technical flaws, it was the mismatch between expectations and reality. Customers were promised premium, flexible experiences. But what they got was friction, silence, or systems that seemed to work against them.

The lesson? When users buy into the dream but instead get a support ticket, NPS takes a hit. Once trust is broken, loyalty is almost impossible to rebuild.

Always Close the Feedback Loop

One of the worst airlines in the US is considered to be United, which had an NPS of 10 in 2014, increased to only 14 by late 2022 – a disaster while compared with its competitors: Southwest (NPS 62), JetBlue (NPS 56) or Virgin America (NPS 48). Since 2012, United has been ranked as the worst or near worst among its competitors.

For years customers have kept complaining about United’s delays, canceled flights, served food, baggage handling and having some of the oldest aircraft in the industry. In 2020, United had one of the worst complaint rates, being responsible for nearly 1 out of 3 complaints filed against all US airlines.

It’s worth mentioning that United always tracked its NPS score, but so do its more appealing competitors, such as Southwest and JetBlue. Why the huge difference in customer satisfaction? The answer is actually simple.

“NPS is core to how we make decisions,” said Robin Hayes, JetBlue’s chief commercial officer.

Even though United measures customer experience and tracks NPS, it seems the airline doesn’t act on customer feedback, at least not fast and satisfactory enough. The most important aspect of an efficient NPS campaign is to close the feedback loop; this is the only way to improve customer satisfaction and become a leader in your industry.

Act on Passive and Detractor Signals

One of the sneakiest ways NPS drops? Not from angry tweets or scathing reviews but from silence.

Too many companies obsess over their Promoters and glowing feedback. They celebrate 9s and 10s, showcase testimonials, and move on. But they completely overlook the Passives and Detractors, the ones who might not tell, but are already halfway out the door.

A perfect cautionary tale here is Yahoo. Once the gateway to the internet, Yahoo was everywhere – email, news, search, even fantasy sports. But over time, the company failed to keep up with evolving user needs and ignored subtle but essential hints. From clunky design updates to a lack of innovation in products like Yahoo Mail and Search, the platform gradually lost relevance. Users didn’t rage-quit. They just… stopped logging in.

Internal missteps and slow product evolution, coupled with data breaches that weren’t clearly addressed, slowly affected trust. And since the feedback wasn’t explosive, it was easy to miss or dismiss. But the churn was happening. Quietly. Consistently. And cumulatively.

By the time Yahoo was acquired by Verizon in 2017, its NPS had reportedly fallen into negative territory. Users had moved on to better, faster, simpler alternatives. It wasn’t one decision that broke user trust. It was a long string of ignored signals.

The takeaway? Promoters tell you what’s working. Detractors and Passives tell you what’s broken. Don’t ignore the quiet ones – they hold the key to stopping churn before it starts.

Measure and Improve Your Net Promoter Score With Retently

A low Net Promoter Score can have significant implications for success, including high customer churn and negative word-of-mouth. By taking proactive steps to address the root causes of a low NPS, such as implementing customer feedback systems and offering tailored solutions, businesses can not only meet customer expectations and increase satisfaction but also improve their bottom line.

Ultimately, a poor NPS score reflects a lack of commitment to delivering exceptional customer experience. By prioritizing CX throughout the customer journey, companies can create a loyal audience to help them thrive in the long run.

Curious where your blind spots are? Start with your next NPS survey and actually act on it.

Retently NPS automates the process of surveying your customers, letting you learn how they feel about your product while you focus on running your business. Sign up for a free trial, set up your CX survey campaign in minutes, and start collecting invaluable customer feedback. Improve your company’s NPS score to unlock the potential of customer loyalty and, as a result, drive revenue growth.

Greg Raileanu

Greg Raileanu

Alex Bitca

Alex Bitca