Table of Contents

- Key Takeaways

- Capturing Key Insights: How We Use Retently Across Customer Lifecycle Stages

- Crafting the Perfect Survey: Retently’s Approach and Tips for Success

- Integrations: Streamlining Processes and Data Flows

- Tracking CX Trends: Unlocking Insights Across Customer Segments

- Turning Feedback into Success With Retently

At Retently, we don’t just talk about the power of customer feedback—we live it. As a leader in customer satisfaction tools, we provide businesses with the means to gather, analyze, and act on critical insights that drive loyalty and growth. Through our CX surveys and advanced feedback analytics, we enable businesses to truly understand their customers and turn that understanding into action.

But here’s the catch—we don’t just help other companies thrive; we rely on our own platform to fuel our success. That’s right, we use Retently daily to sharpen our approach, refine our services, and meet the needs of our clients.

In this article, we’re pulling back the curtain to show you how we leverage our own product to improve and stay connected with our clients. From perfectly timed surveys to actionable insights, you’ll see how Retently drives our growth—and how it can do the same for you.

Key Takeaways

- We use post-trial and recurring NPS feedback to consistently refine our product and quickly adapt to customer needs.

- Helpdesk CSAT surveys provide insights into support performance and allow us to make adjustments that enhance customer satisfaction after every interaction.

- CES surveys highlight how easily new users adapt to our product, enabling us to smooth out onboarding challenges.

- PMF surveys guide our roadmap and help identify our Ideal Customer Profile (ICP), focusing our efforts on must-have features.

- By analyzing trends across customer segments, we adjust our offerings to stay relevant and meet specific customer needs.

Capturing Key Insights: How We Use Retently Across Customer Lifecycle Stages

Using CX surveys effectively goes beyond a one-time effort—it’s about collecting and acting on feedback throughout the customer journey. We’ve fine-tuned our process by strategically deploying surveys after key events, like the end of a free trial or after cancellation. By personalizing questions and automating survey delivery, we gather detailed insights that keep us in sync with our customers’ needs.

Some of these surveys are core to our approach, actively triggered at specific touchpoints or on a recurring schedule to monitor the customer experience. Others are experiments we’ve explored to capture targeted data. No matter which method you choose for your specific use case, know that it’s been thoroughly tested and will deliver the actionable insights you’re after.

Now, let’s explore the types of surveys we’ve leveraged over time to make informed decisions and strengthen customer relationships.

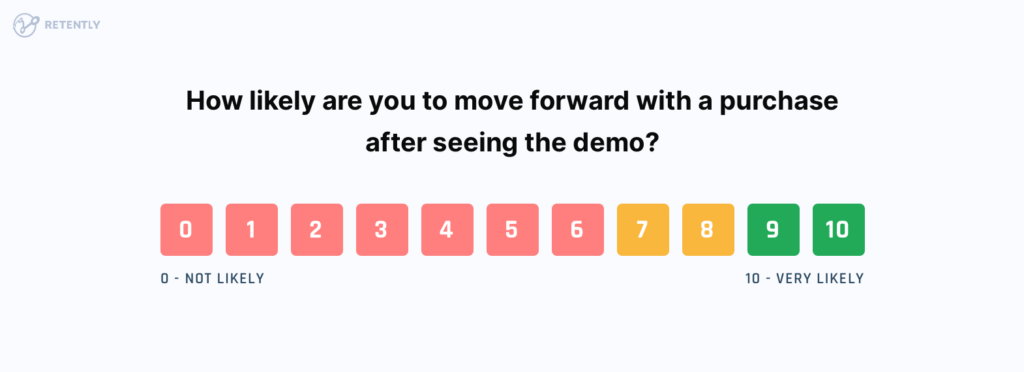

Post-Demo Call Survey: Turning First Impressions into Actionable Insights

The demo call is often the first live interaction a potential customer has with our product, making it a critical touchpoint in the customer journey. To capitalize on this moment, we deploy a Post-Demo Call Survey to capture immediate feedback from prospects while their experience is still fresh. This survey allows us to understand how well the demo resonated with them, whether it effectively showcased the value of our product or addressed their specific needs.

The insights gathered from this survey are invaluable for fine-tuning our sales approach. For example, if feedback suggests that certain features were unclear or that the demo didn’t fully meet expectations, we can adjust our presentation to better align with customer interests. This feedback loop ensures that each demo becomes more targeted and effective, increasing our chances of converting leads into paying customers.

Beyond refining our demo process, the Post-Demo Call Survey also helps us spot potential customer concerns early on. If a prospect expresses hesitation or points out areas where they feel the product falls short, we can immediately address these issues with follow-up communication or additional resources. This proactive approach shows that we’re committed to understanding and meeting their needs right from the start.

Post-Trial NPS: Unlocking the Why Behind Customer Decisions

Every free trial tells a story, whether it ends in a conversion or not. For us, the real value lies in understanding the factors behind both outcomes. After the trial ends, we send a post-trial NPS survey to ask what drives customer decisions. Did our product meet their needs, or did something fall short? This survey helps us dig into the details.

Timing is everything. We’ve mastered sending the survey at just the right moment—after the trial ends but before users disengage. This ensures that their feedback is both reflective and relevant. However, gathering feedback is only the first step. When trial users share their concerns—whether it’s a missing feature, an unclear onboarding process, or another roadblock—we don’t just listen; we take action.

Our follow-up could be a personalized demo, a guide highlighting features they might have missed, or simply directing them to the right resources. The goal is always the same: turn every trial into an opportunity to improve, adapt, and eventually win over more customers.

Understanding why a user didn’t convert during the trial isn’t just about fixing a problem but streamlining the entire experience. Our post-trial NPS survey provides us with the insights needed to keep evolving and ensure that our product exceeds the expectations of future customers.

Post-Onboarding CES Survey: Supporting Every Step of the Journey

Once customers start using our product, it’s important to ensure everyone on the team feels comfortable and equipped to make the most of it. Onboarding isn’t a one-time event—it’s an ongoing process as new team members come and go. To make sure that everyone finds our product easy to use, no matter when they start, we rely on CES (Customer Effort Score) Surveys. These surveys help us understand how smoothly each team member is getting up to speed with our product.

Instead of sending the survey just once, we send it to every new user after they’ve had some time with the product—whether they’ve been using it for a few weeks or are just starting out. This way, we can see how well our onboarding process works for both new and existing users.

If the survey shows someone is struggling, we don’t wait to step in. We adjust our training materials, offer extra help, or share additional resources to help them get the needed support. Our goal is to keep improving the onboarding experience so that it’s smooth and effective for everyone, no matter when they join.

With these CES surveys, we make sure onboarding is always a positive start that sets our users up for success from day one.

We’ve also tested sending CES surveys after key user actions, like setting up integrations or creating their first campaign, and following self-service support interactions, such as using our knowledge base or FAQs. This has helped us ensure that users are not only successfully onboarded but also easily deal with key aspects of our product.

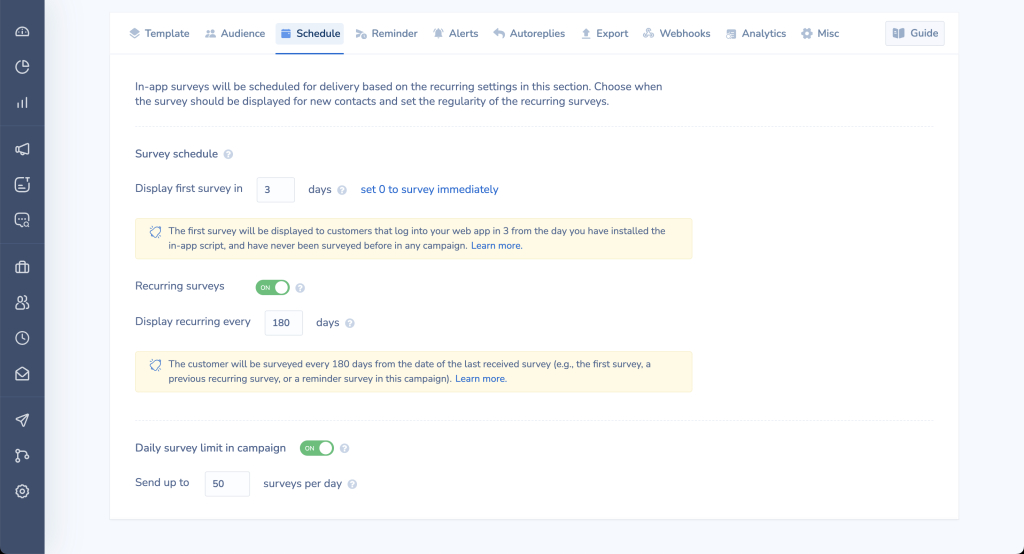

NPS Recurring Survey: Keeping a Pulse on Customer Sentiment

Maintaining a strong connection with our customers requires ongoing engagement. That’s where our NPS recurring survey comes in. Every 180 days, we reach out to users who log into our platform to gauge their satisfaction and keep a pulse on their evolving needs. This semi-annual check-in provides consistent feedback, helping us identify trends, detect potential issues early, and adjust our strategies before minor problems become major challenges.

The beauty of the recurring NPS survey is its ability to track changes over time. By comparing data from previous surveys, we can see how customer sentiment shifts and understand what’s driving those changes. Are users more satisfied as we roll out new features, or are there concerns that need attention? This data allows us to be proactive rather than reactive and keep improving our product.

We also recognize that not all customers engage with surveys in the same way, so we’ve made it easy and convenient to share their thoughts. We use both web in-app surveys and follow-up email reminders to reach customers where they’re most comfortable. If a user doesn’t respond to the in-app survey, we send a reminder via email, giving them another chance to weigh in. Switching to a different survey template for the second attempt also tends to increase engagement.

But the NPS recurring survey isn’t just about gathering scores; it’s about closing the loop. When we receive feedback, especially if it indicates a drop in satisfaction, we take immediate action. Whether it’s reaching out to offer support, address specific concerns, or simply acknowledge their input, we aim to ensure every customer feels heard and valued.

Helpdesk CSAT Survey: A Must for High-Volume Support Teams

When your support team handles a high volume of customer inquiries, ensuring every issue is resolved smoothly is crucial. During busier periods, we’ve made it a priority to send post-support CSAT surveys to get immediate feedback on how well our team is performing. While that is not a primary scenario for us, given the low ticket volume, we know that for many companies, this type of survey is a game-changer. That’s why Retently offers a simple way to set up and automate Helpdesk Surveys for those who need them.

By following up on resolved tickets with a quick survey – typically including a CSAT question – we can ensure that issues are managed efficiently, response times are on point, and customers leave happy. Yet, we don’t just react to inquiries; we also take proactive support steps, such as monitoring common issues and updating the Knowledge Base or FAQs for guidance.

For businesses with a busy helpdesk, this feedback is invaluable. It helps fine-tune support processes and make sure no customer slips through the cracks. By integrating Helpdesk Surveys into the workflow, we can maintain the quality of our service and keep clients satisfied.

While CSAT surveys are most commonly used post-support, they are not limited to that. We’ve tested them in the post-onboarding phase and to evaluate satisfaction with specific feature releases. CSAT surveys served us well in these use cases as well.

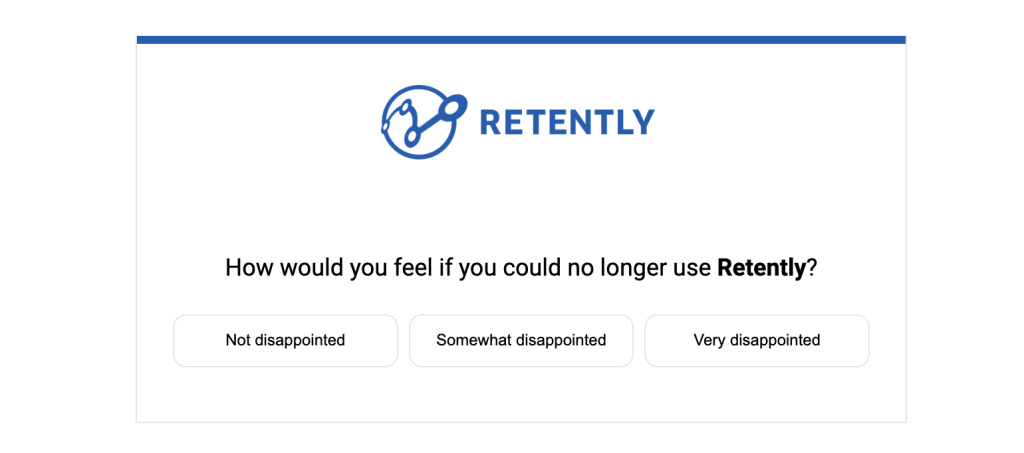

Product-Market Fit Survey: Making Sure Our Product Is a Must-Have

How do we know if our product truly hits the mark? That’s the question our Product-Market Fit (PMF) Survey is designed to answer. The PMF Survey is our way of measuring how essential our product is to the people who use it, in order to keep up with their needs and expectations.

In the past nine years, we’ve conducted two Product-Market Fit surveys that have shaped our product roadmap and defined our Ideal Customer Profile. By asking how customers would feel if they lost access to our product and which features they find most valuable, we’ve gained insights into what truly matters to them and how relevant our product is in their daily lives.

Why is this feedback so crucial? Because it tells us if we’re on track or need to make changes. If customers say they’d be very disappointed without our product, we know we’re delivering real value. But if the response is somewhat indifferent, it’s a clear sign we need to step up our game. This feedback directly influences our product development, helping us prioritize the most important features and improvements to our users.

But the PMF Survey isn’t just about identifying gaps—it’s about staying ahead. This process helps us refine our roadmap, ensuring we’re always building something that’s not just useful but indispensable.

Churn Surveys: Identifying Specific Reasons for Customer Departures

Churn Surveys provide detailed feedback from customers who decide to cancel or downgrade their subscriptions. These surveys focus on gathering specific information about the reasons behind their decision. Whether it’s dissatisfaction with certain features, concerns about pricing, or better alternatives on the market, the data we collect helps us pinpoint exactly where things went wrong.

By analyzing these responses, we can identify common patterns and areas that need improvement, such as feature gaps or support issues. This information is crucial for making targeted adjustments to our product, pricing models, or customer service practices to reduce future churn and downgrades.

Additionally, Churn Surveys give us a chance to address unresolved issues and potentially re-engage customers. By following up on their feedback, we may find opportunities to win back their business or at least prevent negative word-of-mouth and improve the experience for other customers moving forward.

Crafting the Perfect Survey: Retently’s Approach and Tips for Success

We’ve learned that the most effective surveys go beyond a single question. While the rating question – whether NPS, CSAT, or CES – is a good start, we dive deeper by including tailored open-ended questions or experimenting with multiple-choice questions to capture insights that numbers alone can’t provide.

For example, multiple-choice questions are particularly suited in churn surveys, as departing customers are less likely to spend time on detailed feedback. On the other hand, pairing a rating question with a couple of open-ended follow-ups is ideal when you want to dig deeper into customer opinions, such as in PMF surveys.

Yet, most of the time you will find yourself combining them for more nuanced feedback. For instance, you might start with an NPS question like, “How likely are you to recommend our product?” to measure overall loyalty. Next, you could include a multiple-choice question such as, “What do you like most about our product?” with options like pricing, feature set, or ease of use, for an idea of what customers value most. You can then follow up with an open-ended question on future intentions: “What specific improvements would you like to see from us in the future?”. Even if some customers do not share qualitative feedback, the multiple-choice responses will already offer a good understanding of their preferences.

With Retently, you can actually tweak your template to include a variety of questions, but we recommend sticking to the most relevant ones to increase response rates. Annoying customers with too many questions will only reduce the quality of your feedback. We also take our time to customize every aspect of the survey – from branding and colors to buttons and layout – so it aligns perfectly with our brand’s identity.

Our advice? Take full advantage of Retently’s flexibility to craft appealing surveys that blend various question types. Whether it’s understanding what’s working well or identifying areas for improvement, a personalized approach, the right mix of questions and appropriate timing can make all the difference.

By going beyond the basics and A/B testing our approaches with Retently, we manage to keep up with our customer’s needs and deliver meaningful outcomes.

Integrations: Streamlining Processes and Data Flows

We focus on making our feedback collection process as smooth and efficient as possible by connecting Retently with the tools we rely on. This integration helps us handle requests faster and more effectively. Here’s how we do it step by step:

1. Syncing Contacts from Pipedrive:

First, we connect Retently to Pipedrive, our go-to CRM. This integration keeps our customer data up-to-date, automatically syncing contacts to maintain accurate records. This setup allows us to manage and trigger surveys effectively, making sure that our outreach is timely and aligned with customer interactions.

2. Triggering Surveys with Chargebee:

Next, we integrate with Chargebee, our subscription management tool. This allows us to automatically trigger surveys based on key transactions, like when a customer activates a subscription or renews. By tying feedback to these critical moments, we capture insights exactly when they’re most relevant.

3. Using our Google Workspace:

Sending email surveys through our Google Workspace lets us control communication channels while maintaining brand consistency. This approach builds trust with recipients by using a familiar domain and integrates seamlessly with our workflows, simplifying response tracking and follow-ups. Retently’s customers can also leverage the Custom From feature to personalize their own surveys.

4. Exporting Feedback Back to Pipedrive:

Once a survey is completed, we ensure that all feedback data is exported directly back into Pipedrive. This includes not just the survey score but also detailed notes and customer comments. When a customer responds to a survey, a new note is created in Pipedrive, attaching all relevant details to their profile. This means that every team member can easily access the latest feedback and act on it.

We also track customer satisfaction at the organizational level by leveraging our Account CX functionality. For example, when multiple users from the same company complete a survey, we group their responses under the same account. This allows us to see how different users within the same organization feel about our product, giving us a broader view of the company’s overall satisfaction.

The computed account-level CX score is also exported to Pipedrive. This helps us monitor each account’s overall health and proactively address any concerns before they escalate.

5. Real-Time Feedback in Slack:

Finally, we bring it all together with Slack. Survey feedback is sent straight to our Slack, where our product, support and CS teams can review and respond in real-time. This keeps everyone in the loop and ensures that no feedback goes unnoticed.

That’s how we do it, but the beauty of Retently is that you can integrate it with the tools that work best for you. Whether it’s through Zapier or our native integrations with platforms like Salesforce or Hubspot, you can easily connect Retently to the tools that fit your workflow.

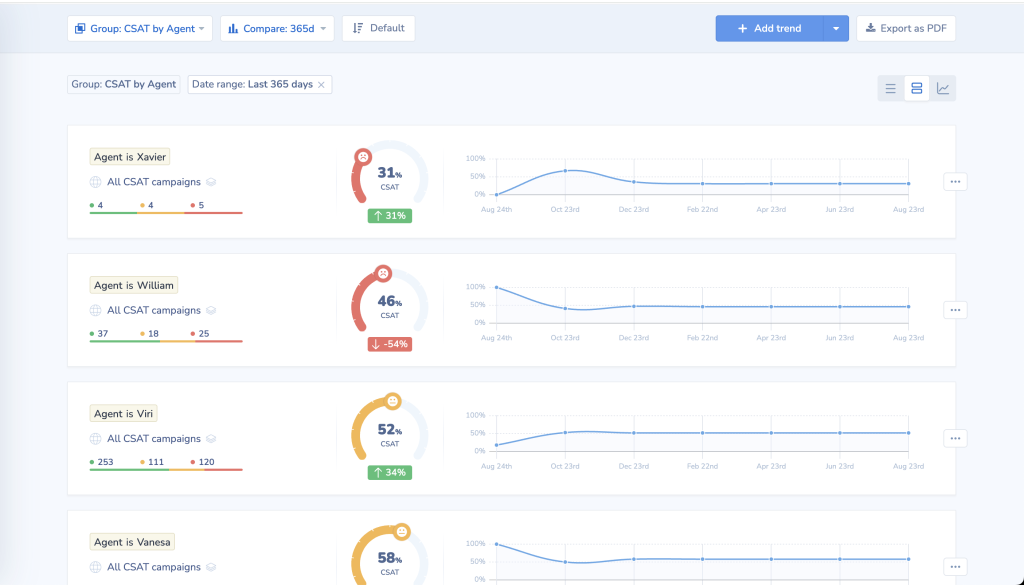

Tracking CX Trends: Unlocking Insights Across Customer Segments

Our CX Trends feature is like a spotlight that reveals how customer satisfaction shifts across different customer segments or product traits. By keeping a close eye on these trends, we gain valuable insights that help us fine-tune our offerings and stay in sync with our customers’ needs. Here’s how we make the most of tracking trends in three key areas:

Customer Tier

We track satisfaction based on subscription tiers or packages. This helps us understand what each group values most and ensures that our plans stay relevant and competitive. By spotting trends in NPS scores and feedback across different tiers, we can adjust our services to better meet the unique needs of each segment. Whether it’s a basic plan or a premium package, we make sure every customer gets the value they expect.

Roles within the Company

Different roles within an organization interact with our product in their own ways. By tracking satisfaction across roles—whether it’s end-users, decision-makers, or technical teams—we can tailor our approach to address each group’s specific needs. This helps us ensure that everyone, from the frontline users to the executives, gets the most out of our product and enjoys a more personalized and satisfying experience.

Industry Segmentation

Each industry comes with its own set of challenges and needs. By tracking trends across the industries we serve, we can spot patterns in satisfaction and adjust our offerings accordingly. Whether a particular industry’s scores are trending up or down, this data helps us stay ahead of the curve and ensure our product continues to hit the mark in key markets.

Turning Feedback into Success With Retently

Over the years, we’ve realized that feedback is more than just data, it’s the core of meaningful actions and lasting success. By eating our own dog food, we’ve consistently refined our strategies, strengthened customer relationships, and enhanced our offerings. The captured insights have allowed us to respond effectively to customer needs and keep our business on a steady growth path.

With Retently, we’ve developed a deeper understanding of what our clients value and where improvements are needed. This ongoing engagement has enabled us to reduce churn, increase loyalty, and consistently deliver more value. By actively listening and adapting based on feedback, we’ve made Retently essential to our success.

Now, we’re excited to help you achieve the same results. Whether your goal is to boost customer satisfaction, refine your product, or stay closely connected with your clients, Retently gives you the tools to make it happen.

Start your journey with Retently today and see how it can transform your business. Leverage our free trial and see firsthand how customer feedback can drive your success.

Christina Sol

Christina Sol

Greg Raileanu

Greg Raileanu

Alex Bitca

Alex Bitca