Are your surveys yielding questionable data? The issue might lie in bad survey questions. From biases to respondent confusion, these flawed questions can skew results and invalidate your data.

This article breaks down typical mistakes, showing you how to spot and eliminate problem areas to enhance the quality of your surveys.

Stick around, and let’s get your survey game on point.

Key Takeaways

- Effective survey design requires recognizing and avoiding biased or poorly constructed questions – leading, loaded, and double-barreled – to ensure high-quality and reliable data.

- Creating clear, precise, and balanced survey questions can enhance respondent engagement and data quality by minimizing confusion and encouraging honest responses.

- Using technology and smart question structuring, such as survey logic features and pre-testing, can streamline the survey process, cater to different devices, and significantly improve the collection of actionable insights.

What Are Bad Survey Questions?

Alright, let’s get into the nitty-gritty of what makes a survey question a “bad” one. You might think a bad question is simply one that’s hard to understand, but it goes much deeper than that. A bad survey question is essentially any question that fails to collect clear, unbiased, and actionable data. These questions can throw off your data’s accuracy and, let’s be honest, waste everyone’s time.

How come? Bad survey questions can wreak havoc on your data quality. If your questions are unclear or biased, the answers you get won’t reflect the true opinions or experiences of your respondents. This results in unreliable data, which can throw off your entire analysis and lead to poor decision-making.

But it doesn’t stop there. Bad survey questions also negatively impact the respondent’s experience. Imagine trying to answer a question that doesn’t make sense or feels intrusive – it’s frustrating, right? When people encounter such questions, they’re more likely to abandon the survey entirely or rush through it without giving thoughtful answers. This means you lose valuable insights and the time you spent creating the survey goes to waste.

Moreover, poor survey design undermines the reliability of your results. If respondents are confused or annoyed, their responses will be inconsistent. This makes it hard to draw any meaningful conclusions from your data, leaving you with a flawed understanding of the issue at hand.

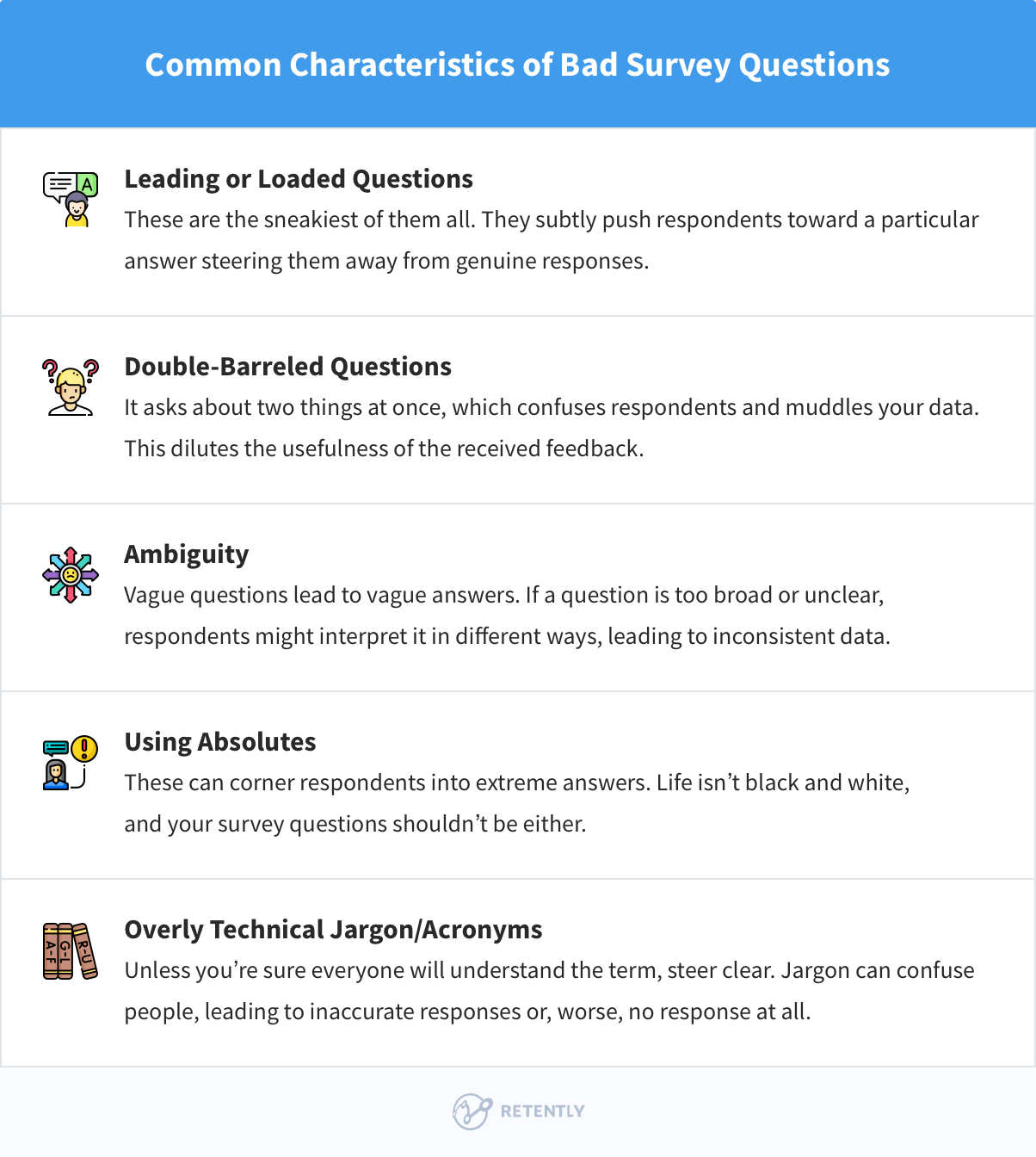

Recognizing the Red Flags: Identifying Bad Survey Questions

Navigating the path to collecting high-quality data through surveys can be challenging, with many potential pitfalls that can compromise your results. Understanding what makes a survey question bad is the first step toward avoiding these pitfalls and ensuring your surveys are effective and insightful.

Stick around, and soon, you’ll be spotting bad survey questions from a mile away and crafting questions that get you the clear, actionable data you need.

Ready to dive deeper into what not to do?

Mistake 1: Leading or Loaded Questions

Navigating the minefield of survey question design isn’t as daunting as it sounds. Let’s break down some of the top mistakes to avoid, starting with one of the biggies: leading questions.

Leading questions are the smooth talkers of the survey world – they subtly push respondents toward a specific answer, often the one the survey creator prefers. Loaded questions are similar to leading questions but carry an additional layer of emotional or biased language, containing implicit assumptions that may skew responses.

Thus, these types of questions have the power to influence how someone responds based on how it’s worded, using subjective descriptors and charged terminology. It contains a built-in assumption that puts pressure on the respondent to answer a certain way. This bias compromises the integrity of the feedback, leading to higher survey abandonment rates and data that does not accurately reflect customer experiences. This can make you think you’re on the right track when you’re actually off course.

Examples of Bad Survey Questions

Let’s look into several examples:

- “Don’t you agree that our customer service is top-notch?”

- “How beneficial do you find our revolutionary product?”

- “Wouldn’t you prefer our service over the competition?”

- “How great is our new product?”

- “Don’t you agree that our product is amazing?”

- “Why do you think our product is the best on the market?”. This question assumes that the respondent thinks the product is the best. A better version would be “How would you rate our product compared to others on the market?”.

These examples show how word choice can steer responses in a specific direction, potentially creating a false sense of consensus or satisfaction.

Tips on How to Spot and Avoid Them

- Check for Assumptions: Ensure your questions don’t assume anything about the respondent’s feelings or opinions. Revisit each question and ask yourself if it suggests a specific response. Questions should be open-ended and free from any presumption.

- Stay Neutral: Use neutral wording. Instead of asking “How refreshing was our new drink?” you could ask, “How would you describe the taste of our new drink?”. This allows the respondent to provide an unbiased answer.

- Keep an Open Mind: The goal of a survey is to discover what people actually think, not to confirm what you want to believe. Don’t ask questions that seek to confirm your biases or hopes. Frame questions in a way that all possible answers are equally valid and expressible.

By steering clear of leading or loaded questions, you’re on your way to crafting surveys that give you the real scoop, not just what you might want to hear. Next up, let’s tackle another common mistake that can trip up your survey’s effectiveness: double-barreled questions. Stick around, we’re just getting started on cleaning up those surveys.

Mistake 2: Double-Barreled Questions

Double-barreled questions are like those two-for-one deals that sound good until you realize they’re more confusing than beneficial. These questions ask about two different things at once, forcing respondents to give one answer for two separate issues. This can muddy the waters of your data, making it hard to know which part of the question was addressed in their response.

Examples of Bad Survey Questions

Ever seen a question like, “How satisfied are you with our pricing and product quality?” or “How satisfied are you with our product quality and customer service?”. This is a classic approach.

This question assumes that one’s opinion on product quality is directly related to their opinion on customer service, which might not be the case. Here are some more examples to consider:

- “How effective are our teaching methods and the course content?”

- “Is our website easy to navigate and visually appealing?”

- “How satisfied are you with our website’s design and functionality?”

- “Do you agree that our gym equipment is modern and our staff is friendly?”

These questions make it impossible to determine which aspect the respondent is commenting on, which dilutes the usefulness of the feedback.

Strategies to Simplify Questions for Clarity

- Break It Down: The easiest way to avoid double-barreled questions is to split them into separate questions. Instead of asking about product quality and customer service together, ask, “How satisfied are you with our product quality?” and “How satisfied are you with our customer service?” separately.

- Focus on One Topic per Question: Each should aim to gather data on one specific issue or topic only. This keeps your data clean and your analysis straightforward.

- Keep it Simple: Aim for simplicity in your question design. The more straightforward and focused the questions, the better the quality of the responses you will receive.

By keeping your questions to the point, you’ll make it easier for respondents to provide clear, useful answers. This clarity will improve the quality of your data while enhancing the respondent’s experience. Up next, we’ll explore the pitfalls of using ambiguous or vague wording.

Mistake 3: Ambiguous or Vague Wording

Ever get a survey question that leaves you pondering, “What do they mean by that?”. If so, you’ve encountered the notorious ambiguous or vague wording in survey questions. This kind of unclear phrasing can lead to a range of interpretations, causing respondents to guess what you’re asking and likely skewing your precious data.

Examples of Bad Survey Questions

Questions like “Do you regularly use our products?” can be too general. What does “regularly” mean? Every day, once a week, once a month? Clarify it to “How many times a week do you use our product?”. Another example, “Do you think our customer service is good?” is too broad. What exactly does “good” mean here?

Guidelines for Using Specific and Clear Language

Let’s unpack why clear and precise language is crucial and how you can ensure your survey avoids the ambiguity trap:

- Define Terms Clearly: If your question involves complex terms, define them. Better yet, rephrase the question to avoid such terms unless you’re certain every respondent understands them.

- Be Precise: Vague questions lead to vague answers. Avoid broad terms and generalizations. If you’re asking about satisfaction, specify what aspect of satisfaction you’re interested in. Instead of “Are you satisfied with our service?” ask “How satisfied are you with our customer support response time?”. If a question is too broad or unclear, respondents might interpret it in different ways, leading to inconsistent and unreliable data.

- Use Simple Language: Keep the language simple and direct. Big words and complex phrases might sound impressive but can confuse respondents. The goal is to be understood, not to show off your vocabulary.

- Avoid Double Negatives: Using negative phrasing in survey questions can really confuse respondents, turning the whole process into a tricky puzzle where a “no” might actually mean “yes”, and vice versa. Double negatives are especially notorious for causing misunderstandings. Questions like “Do you disagree that our service shouldn’t be improved?” are a big no-no. They’re confusing and make it hard for respondents to answer clearly. Keep it positive and straightforward.

- Review and Simplify: After drafting your questions, go through them again with the mindset of cutting out any unnecessary words or overly complex structures. Simplify wherever possible to enhance clarity. Regularly review your surveys to ensure they remain clear and relevant.

By tightening up your language and being as specific as possible, you ensure that respondents understand exactly what you’re asking. This clarity leads to more reliable data, making your survey a much stronger tool for decision-making. Up next, let’s tackle how using absolutes in your questions can limit the usefulness of your responses. Stick around for more survey cleanup tips.

Mistake 4: Using Absolute Terms and Extremes

When crafting survey questions, throwing in words like “always”, “never”, “all”, or “none” might seem like a good way to gauge strong opinions or behaviors. However, using absolute terms can actually backfire by forcing respondents into a corner. These words can lead to skewed responses that don’t accurately reflect the nuances of human behavior or opinion. Life isn’t black and white, and your survey questions shouldn’t be either.

Absolute terms eliminate any middle ground. They force respondents to either fully agree or disagree, which can be misleading. For many people, answering that they “always” or “never” do something doesn’t quite fit their reality, which might lead them to either abandon the survey or choose an answer that doesn’t accurately reflect their opinions or behaviors. This can distort your data, making it seem like your respondents are more polarized than they actually are. For example, asking “Do you always recycle?” might lead someone who recycles frequently but not always to answer no, which doesn’t accurately reflect their generally positive behavior toward recycling.

Crafting More Balanced and Open-Ended Questions

- Avoid Extremes: Instead of asking, “Do you always use eco-friendly products?” try “How often do you use eco-friendly products?”. This change from absolute to frequency can provide more accurate and graded insights into behaviors.

- Encourage Honest Responses: Frame your questions to encourage honesty without judgment. Phrasing like, “To what extent do you agree…” invites respondents to consider a spectrum of answers rather than a binary choice. Likert scales are excellent for capturing the range of feelings or behaviors. Asking “How strongly do you agree with the following statement?” followed by a series of options from “Strongly disagree” to “Strongly agree” helps gather nuanced data.

- Open-Ended Alternatives: When appropriate, allow for open-ended responses. Questions like, “What could improve your experience with our service?” invite a range of answers, giving you richer qualitative data.

- Avoid Bias in Phrasing: Make sure your questions are neutrally worded. Bias can sneak in through absolutes by implying that one answer is the right one. For instance, instead of asking, “Do you never skip breakfast?” you might ask, “How often do you eat breakfast in a typical week?”.

- Review and Reflect: Go through your survey with a fine-tooth comb, looking for any absolutes that might have slipped in. Replace them with more flexible, inclusive language where appropriate.

By moving away from absolutes and embracing more graded or open-ended questions, you make your survey more respondent-friendly while enhancing the quality and reliability of the data you collect. Coming up next, let’s dive into how jargon and acronyms can alienate respondents, and how you can keep your survey accessible to all.

Mistake 5: Overuse of Technical Jargon or Acronyms

Dropping technical jargon or acronyms into your survey questions is like speaking in code – only a select few will understand, and you’ll leave everyone else feeling a bit lost. This can alienate or confuse respondents who might not be familiar with the specific lingo of your field, leading to incorrect answers or causing them to drop out of the survey altogether.

Using specialized terminology assumes that all your respondents have the same level of knowledge or background, which is rarely the case.

Recommendations for Using Layman’s Terms

- Simplify Your Language: Unless you’re 100% sure every respondent will understand the terminology, steer clear. Replace technical terms with simpler, more common alternatives. For instance, instead of asking about “aerobic capacity”, you could ask, “How long can you run before feeling tired?”. This makes your question understandable to a broader audience.

- Define Terms When Necessary: If you must use specific terms, provide a definition in the question. This helps ensure everyone is on the same page. For example, “When we say “ROI” (Return on Investment), we mean the gain or loss generated on an investment relative to the amount of money invested. How do you rate the ROI on our new product?”

- Use Everyday Examples: When possible, anchor abstract concepts in everyday examples. This approach can help clarify complex ideas through familiar scenarios. For instance, if you’re surveying internet security, instead of referencing “phishing attacks”, you could describe them as “attempts to trick you into giving out personal information like passwords”.

- Keep It Conversational: Aim for a friendly, conversational tone that feels like talking to a friend. This approach can make your survey more engaging and less intimidating. Remember that your survey should be as inclusive as possible. Avoiding jargon and acronyms isn’t just about clarity, but also about ensuring that everyone, regardless of their background, feels welcome to participate.

- Review and Revise: Always look over your questions to cut out unnecessary jargon. Ask yourself if there’s a simpler way to say the same thing. Often, there is.

- Ask for Feedback: In your survey, consider including a question about whether the language used was clear. This ongoing feedback can be invaluable for improving future surveys.

By ensuring your survey speaks the language of your respondents, you make it more accessible and increase the likelihood of accurate responses.

Additional Pitfalls to Avoid

Navigating survey design can be tricky, and even when you’ve managed to avoid major mistakes, there are still other pitfalls that can compromise your data quality. Let’s explore a couple more areas where survey designers often stumble.

Pitfall 1: Insensitive or Biased Question Framing

In crafting survey questions, it’s important to be mindful of cultural and personal biases that can inadvertently influence how questions are framed. This can lead to responses that are not truly reflective of the respondent’s opinions, or even offensive.

To prevent this, before finalizing your survey, have individuals from different backgrounds review it to catch any potentially biased or sensitive phrasing. Avoid words that carry strong emotional implications or cultural biases. Stick to factual and unbiased language. Also, make sure to frame questions in a way that allows for any experience to be valid.

Avoid idiomatic expressions or references that might not translate well across cultures. Instead of saying, “Rate your experience from 1 to 10, with 10 being over the moon,” use, “Rate your experience from 1 to 10, with 10 being extremely satisfied.”

Pitfall 2: Incorrect Scaling

Scaling in surveys refers to the set of answer options provided for a question. Errors in scaling can lead to confusion among respondents and difficulties in analyzing the data. Some common scaling errors to look into:

- Scales that aren’t consistent across similar questions can confuse respondents and impair the comparability of responses. Using different scales (e.g., 1-5 in one question, 1-10 in another) within the same survey can confuse respondents.

- Scales with uneven intervals between points can mislead respondents about the meaning of their selections.

Match the scale to the variability you expect in answers. A 1-5 scale might be sufficient for a straightforward satisfaction question, but a 1-10 scale could be better for more nuanced feedback. Additionally, provide clear definitions for scale points, especially for subjective measures. Explain what each number in the scale represents to avoid different interpretations.

Pitfall 3: Lack of Personalization

Navigating the diverse waters of a target audience requires a personal touch – tailoring your survey to fit the unique traits of different segments. By refining your questions to resonate with specific groups, you’ll get responses that are not only more relevant but also richer in detail. Using personalization as a tool can significantly boost response rates and uncover valuable insights.

Pitfall 4: Survey Length

Your survey should be just the right length, like a trip that’s long enough to reach the destination but not so long that participants lose interest. Focus on the essential questions to keep the survey short while still gathering valuable insights. People’s attention and the quality of their responses usually start to drop off really quickly, with an attention span of 8,25 minutes, so it’s important to be mindful of the survey’s length.

To collect crucial information before respondents get too tired, place open-ended questions at the end of your survey. This way, participants can give thoughtful answers to these more demanding questions after they’ve tackled the simpler ones.

Pitfall 5: Optimizing for User Experience

As we dive deeper into the digital age, it’s more important than ever to design surveys that work smoothly on all kinds of devices. Think of a responsive layout as a well-paved road that makes the drive easy and enjoyable. This not only keeps everything clear but also shows you value the respondent’s time and comfort. By minimizing scrolling and cutting out clunky features on mobile devices, surveys become more user-friendly and less intimidating, which can boost completion rates.

It’s important to thoroughly test your survey across various platforms to ensure everyone has the same great experience, no matter the device they’re using.

By avoiding these additional pitfalls, you can further enhance the reliability and validity of your survey results. Each step you take to remove bias and confusion not only improves the quality of your data but also respects and values the diversity of your respondents.

Case Study Analysis: Examples of Bad Survey Questions

For more context, let’s analyze a poorly designed employee satisfaction survey to highlight specific mistakes.

1. “How often do you feel valued at work?”

- Mistake: Ambiguity

- Issue: “Often” is subjective and can vary greatly between respondents.

- Fix: “How many times in the past month have you received positive feedback from your manager?”

2. “Don’t you think our new office layout is great?”

- Mistake: Leading/Biased Question

- Issue: This question suggests that the new layout is great and pressures respondents to agree.

- Fix: “How do you feel about the new office layout?”

3. “How satisfied are you with the company’s communication and team collaboration?”

- Mistake: Double-Barreled Question

- Issue: This question combines two distinct topics: communication and collaboration.

- Fix: Split into two questions: “How satisfied are you with the company’s communication?” and “How satisfied are you with team collaboration?”

4. “Why do you believe our team meetings are ineffective?”

- Mistake: Loaded Question

- Issue: This question assumes that the respondent finds team meetings ineffective.

- Fix: “What are your thoughts on the effectiveness of our team meetings?”

5. “How would you rate the company’s ERP system’s integration with other software?”

- Mistake: Complex Jargon

- Issue: The term “ERP system’s integration” might not be understood by all employees.

- Fix: “How well does our company’s software work with other tools you use?”

6. “How satisfied are you with your job? Very Satisfied, Satisfied, Neutral, Dissatisfied.”

- Mistake: Unbalanced Scales

- Issue: The scale lacks a negative extreme and skews towards positive responses.

- Fix: “How satisfied are you with your job? Very Satisfied, Satisfied, Neutral, Dissatisfied, Very Dissatisfied.

In these examples, you can see how bad survey questions can creep into your surveys and how to fix them. This understanding will help you design better surveys that yield more accurate and useful data.

Tips to Improve Survey Question Quality

Creating effective survey questions is both an art and a science. It requires careful consideration, testing, and refinement. Here are some tips to ensure your survey questions are of the highest quality and capable of gathering the insightful data you need.

1. Self-Review

Conducting a self-review is the first step in identifying bad survey questions and therefore improving their quality. Here are some techniques you can use to help you evaluate your questions effectively:

- Read Aloud: Read each question aloud. Does it sound clear and straightforward? If you stumble over the wording or if it sounds awkward, it may need rephrasing.

- Put Yourself in Respondents’ Shoes: Imagine you are a respondent with no prior knowledge of the survey’s context. Would you understand the question easily? Would you know how to answer it?

- Check for Clarity and Simplicity: Ensure that each question is clear, concise, and free of unnecessary complexity. Avoid long sentences and complicated words. Avoid technical jargon unless your survey is targeted at a specific audience that understands it.

- Look for Bias and Leading Phrases: Be on the lookout for any wording that might lead respondents toward a particular answer. Strive for neutral, unbiased language.

- Split Double-Barreled Questions: Make sure each question asks about one thing only. If you find any double-barreled questions, split them into separate questions.

- Review Response Options: Ensure that all response options are exhaustive and mutually exclusive. There should be no overlap or gaps in the choices provided.

- Balance Your Scales: If you use rating scales, check that they are balanced with an equal number of positive and negative options.

2. Pre-Testing Questions on a Sample Audience

Pre-testing, also known as piloting, is a critical step in survey design. It involves running your survey with a small, representative group before the full launch. This process can unearth issues with question clarity, formatting, and overall flow that you might not have noticed.

First off, it helps you spot any confusing questions that might trip up your respondents. Plus, it lets you check if all your questions actually make sense for the people you’re asking. You can also tweak the wording based on feedback to make everything crystal clear. And, it’s great for figuring out if your survey is too long, so people don’t get tired out while answering. With pre-testing, you can fine-tune your survey to be easy to understand, relevant, and just the right length for the best results.

Many frameworks and tools are available to help you craft effective survey questions. These resources can help you avoid common pitfalls and adhere to best practices in survey design. Specialized survey software offers templates and tips for designing effective questions and can automate much of the survey process.

3. Iterative Feedback

Iterative feedback involves continuously collecting and incorporating feedback throughout the survey development process, not just during the pre-testing phase.

Here are the key steps for implementing it:

- After designing your survey, test it internally or with a small group of external users.

- Collect detailed feedback on how each question is interpreted and any difficulties respondents face.

- Use the feedback to make targeted improvements to the survey questions.

- Run the revised survey on another sample, gather more feedback, and refine further. Continue this process until no significant issues are reported.

This careful and thorough approach ensures that your surveys are not only well-received but also yield valuable insights that can guide meaningful decisions and strategies.

4. Survey Logic Features

Think of survey logic like a GPS for your questions, making sure respondents only go down the roads that matter to them and answer questions relevant to their experiences. Skip logic is like a shortcut, making the survey quicker and more fun by letting people skip questions that don’t relate to them. Branching logic personalizes the survey journey for everyone, leading to more accurate and focused data.

It’s like modern map-makers carefully planning out the best route for your survey.

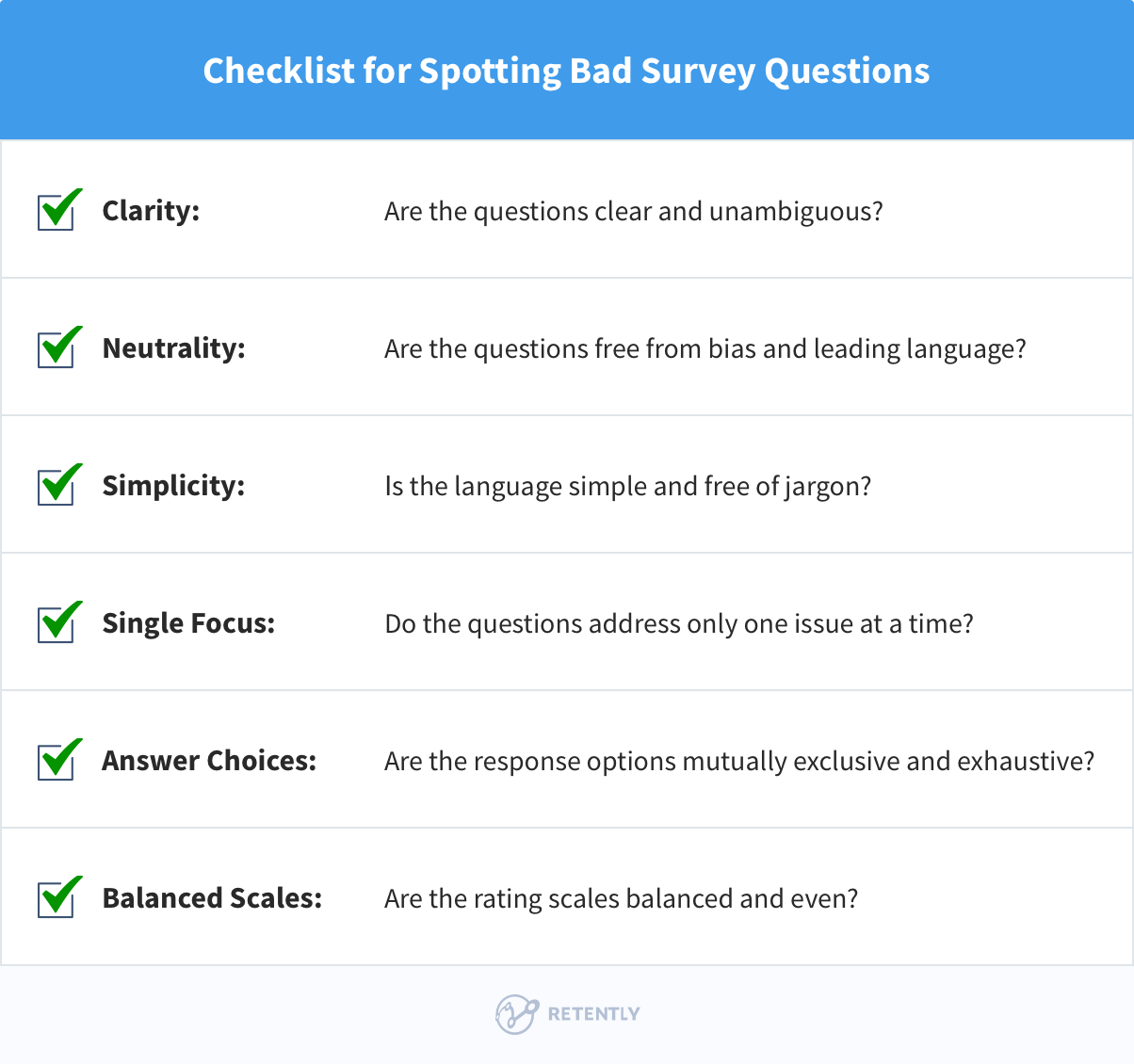

Conclusion

Now that you have a good understanding of what makes a survey question good or bad, it’s time to put this knowledge into practice. Take a moment to review your current surveys and look for common mistakes.

Here’s a simple checklist to help you spot and fix bad survey questions:

- Clarity: Are the questions clear and unambiguous?

- Neutrality: Are the questions free from bias and leading language?

- Simplicity: Is the language simple and free of jargon?

- Single Focus: Do the questions address only one issue at a time?

- Answer Choices: Are the response options mutually exclusive and exhaustive?

- Balanced Scales: Are the rating scales balanced and even?

Apply the strategies discussed to improve the clarity, neutrality and overall quality of your questions. The effort you put into designing better surveys will pay off with more reliable data and valuable insights.

Create your free Retently account – no long-term obligation or credit card is required. Leverage the available templates, automation features, and detailed reports to ensure your surveys remain effective, engaging, and capable of providing the valuable insights you need to make informed decisions. If you’re not sure where to start, let the survey generator suggest questions that drive real insights.

Alex Bitca

Alex Bitca

Greg Raileanu

Greg Raileanu

Christina Sol

Christina Sol