Table of Contents

One of the biggest advantages of Net Promoter Score© is its versatility. Measured every quarter or just after a major transaction, NPS© shall give your business the ability to capture valuable feedback at any moment in the customer lifecycle.

This brings up an interesting question: Is it better to survey customers on a regular basis, such as bi-annually, or after an important event or transaction?

Both methods have advantages and disadvantages, as well as specific characteristics that make them best for learning more about how your customers perceive your product, service, or brand.

In this guide, we’ll look at the key differences between relationship and transactional NPS (tNPS) to help you understand how each survey method can enable business growth, increase retention and generate more actionable insights from your customers.

Key Takeaways

- Net Promoter Score offers valuable feedback at any stage of the customer lifecycle, supporting both business growth and customer retention.

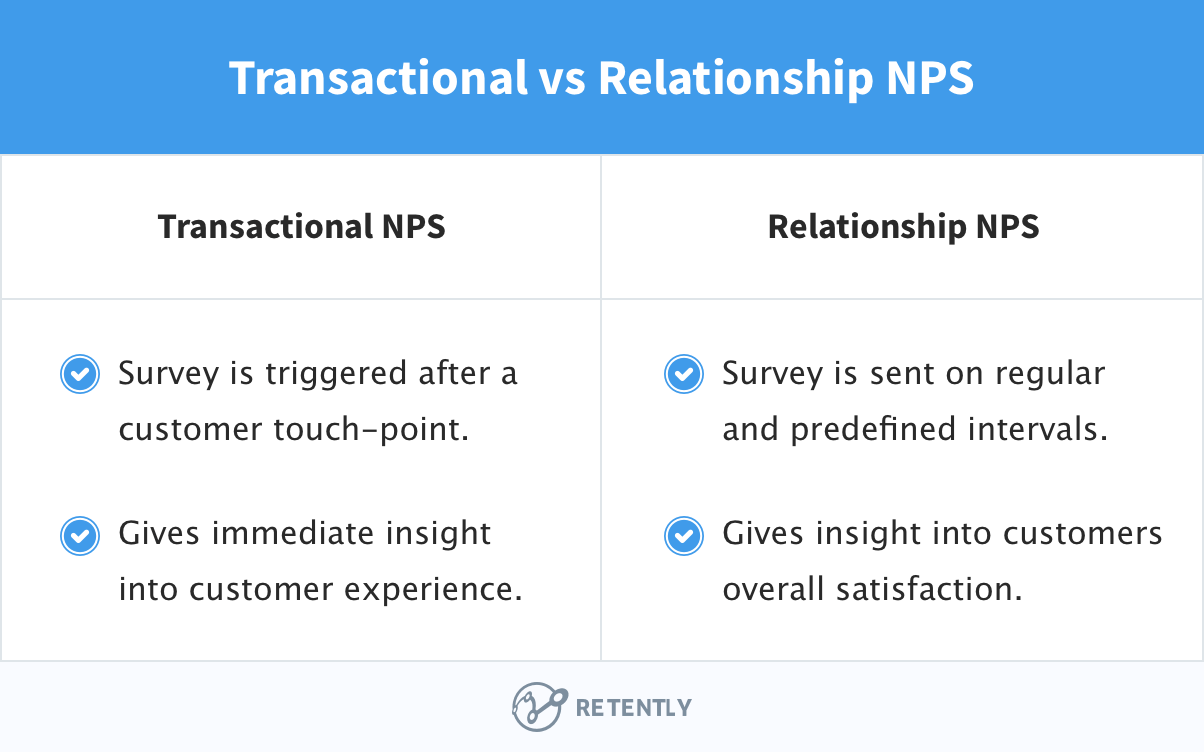

- Relationship NPS measures long-term loyalty and overall brand perception, while Transactional NPS provides immediate feedback after specific interactions, driving quick improvements.

- For best results, conduct Relationship NPS at regular intervals and Transactional NPS right after key transactions to capture accurate customer sentiments.

The ‘What’ and ‘When’ of Relationship NPS

Relationship NPS, also known as on-demand or regular NPS, is designed to assess your business’s relationship with its customers. It serves as the starting point for measuring customer satisfaction and spotting the gaps that need attention.

Thus, using relationship surveys is more about deciding the customer segment to survey and the appropriate timing to conduct it.

- Segmentation: Instead of surveying your entire customer list for general feedback, get the most out of your relationship NPS by segmenting your clients into clusters. Apart from delivering more targeted surveys, segmentation would help avoid surveying customers when an interaction in progress – like an open support ticket – might skew their overall perception.

- Timing of Relationship NPS: Deciding on the perfect timing is up to you. Most businesses send recurring surveys at standard intervals, such as bi-annually or annually.

Because relationship surveys are sent on a scheduled basis and aren’t tied to any specific event, they’re ideal for generating feedback on the strength of the working relationships with your customers and accurately assessing loyalty to the brand and its products. This makes them invaluable for tracking progress over time, allowing you to easily benchmark internal data against NPS industry standards.

Relationship NPS uses general, nonspecific language that doesn’t mention any specific purchase or event. There’s no mention of recent account activity or purchases — instead, clients are asked a standard NPS question.

This way, potential bias imposed by a particular experience is taken out of the way, focusing on the entire interaction instead.

The ‘What’ and ‘When’ of Transactional NPS

While relationship NPS is general and designed to assess the strength of your relationship with a customer, transactional NPS is meant to assess the customer’s opinion on a certain business transaction.

For example, your company might send a Net Promoter Score survey immediately after a client places an order. In this case, the survey is transactional, as it’s explicitly designed to measure how customer satisfaction changed after a recent interaction with your product or service.

Hence, transactional NPS surveys require precise timing in order to capture accurate feedback. Send an NPS survey immediately or shortly after completing the transaction to identify the customer’s opinion on the specific business process. Wait too long, and you risk getting the customer’s perception skewed by other experiences.

With transactional data at hand, you can easily identify any flaws in customer interactions, develop tailored solutions and optimize touchpoints across the customer lifecycle. The captured insights will also provide guidance and motivation to individual teams, as they will have access to real-time data to inform their approach and actions moving forward.

Transactional NPS surveys use specific wording that mentions the transaction. Instead of being asked how likely they are to recommend your business in general, a customer might be asked to rate your company “based on their most recent purchase or order”.

Examples of Transactional NPS Survey Questions

To optimize transactional NPS surveys, tailor the NPS question to reference the particular transaction or event, making the feedback more actionable. Examples include:

- “Considering your recent purchase of [product/service], how likely are you to recommend our company to friends or colleagues?”

- “Based on the service you received from our team today, how likely are you to suggest our services to others?”

- “Following your recent support call regarding [issue/topic], how likely are you to recommend our company to someone you know?”

Each targeted question in the survey should be complemented by an open-ended follow-up, encouraging respondents to provide more depth to their feedback. This method enriches the quantitative data with qualitative insights, allowing customers to detail particular aspects of their interaction – whether it’s the smoothness of a transaction or the effectiveness of a customer service exchange. Such detailed responses add context to the raw scores and provide a clearer picture of the customer experience.

Transactional NPS Surveys You Should Be Sending

A customer’s perception of your company is determined by singular interactions with your brand and will change following upcoming touchpoints, as for example after talking to a support representative, placing a new order, etc.

Surveying your customers after such interactions will help you understand what exactly caused the change in their sentiment and, as a result, acknowledge the positive effect or fix the issue in case of an unpleasant experience.

Let’s look through some touchpoints a transactional customer satisfaction survey will turn handy for:

1. Onboarding

Use transactional NPS surveys to assess the onboarding experience, which mainly determines whether the new customer will adopt your product or shortly churn. By digging into collected data, you will be able to decide on drawbacks in the implementation process and potential opportunities for improvement. By making the process simple and clear via self-service options and a proactive support team, you have a good shot at delivering an onboarding experience that matches customer expectations and positively impacts your retention efforts.

2. Customer Ticket or Call

Send your customer a transactional NPS survey to find out how your support representative has handled a specific situation and whether the proposed solution was helpful to the client. In the pile of daily requests a customer support representative receives, some of the tickets might be neglected being assigned very little importance, get not answered in a timely manner, or the available quick-fix might not solve the raised issue. Engage with your clients to find out about their satisfaction with the latest support interaction and learn of the possible service or product drawbacks you need to address.

3. New Order or Business Transaction

Surveying your audience after placing a new order, or a ride/flight taken, etc. – that is after customers have achieved specific milestones – is extremely important since such transactional interactions are most often related to some pain points. These could refer to a payment process that could not be completed, the necessity to submit a claim, or a shipment that was not delivered properly.

Once again, transactional surveys will prove to be highly actionable. In case a customer has a product delivery or payment issue, the action to be taken to recover the situation is quite clear. In this context, the captured data will help to come up with an immediate solution to a pending issue and, in the long run, facilitate the improvement of core processes which will enhance the overall perception of your product or service.

4. Product Usage

While most of the transactional NPS surveys are sent right after an interaction is completed, sending it a week or two after the product has been delivered is a great opportunity to learn from people who had a chance to already test it and want to share their experience. The same applies to services, not only products, since in order to see their full value or identify specific issues, one needs some time to get an accurate perception of the purchase. Triggering a survey not immediately but shortly after the delivery or service activation will allow you to accurately grasp how customers feel about their purchase and take immediate action on any possible shortcomings.

5. Major Product Update

NPS plays a significant role in the alignment of your product roadmap. Inquiring for customer feedback on your product after a major update can save you from errors that can be overlooked, help you spot and solve issues, prioritize the features to work on, and all this just because you are able to see your newly released updates through your customers’ experience. Thus, if you’ve just launched a new product and want an accurate feel for how your audience responds to it, a transactional NPS survey is far more likely to produce meaningful data than a relationship NPS survey.

6. Post-Event Insights

Post-event surveys are a strategic tool for gauging the impact of corporate events, webinars, and training sessions. By asking for feedback after such gatherings, companies can measure attendee satisfaction, clarify learning outcomes, and identify any gaps in content delivery. For instance, after a product training session, a software firm might use transactional NPS to understand which features resonated with users and which areas require more in-depth explanation. This insight guides the planning of future events, ensuring they are more finely tuned to meet customer expectations.

7. Changes in Customer Accounts

Surveys following significant changes to customer accounts, such as upgrades or subscription renewals, provide essential data on customer satisfaction and service quality. When a customer transitions to a higher service tier, for example, a SaaS company might use a survey to verify whether the customer found the process smooth and the new features beneficial. This feedback is important for refining customer service processes and ensuring that account changes contribute to the user experience.

Transactional or Relationship Surveys?

There’s no “perfect” method for specific businesses. Both transactional and relationship surveys have pros and cons, some of which can make one form of survey more suitable for your company than another.

According to Business Over Broadway, relationship surveys provide information to help with CX strategic decisions (for example, the business areas which need improvement), while transactional surveys generate data to support the tactical decisions (that is, how you will make the improvements happen).

Transactional NPS feedback is ideal for learning about how a customer’s opinion of your business can change based on a particular product, service or offer.

Because transactional NPS data is always tied to a specific product, service, offer or event, it’s also extremely easy to act on. With enough data, you can quickly spot faults, weaknesses, and opportunities to optimize or improve based on customer insights.

Finally, transactional NPS data is immediate. Rather than waiting months to resurvey your clients and view any change in customer sentiment, you can generate actionable insights that let you make effective changes very quickly.

There are also weaknesses to transactional NPS. Because it’s tied to a specific event, it’s very time-consuming without automation. Luckily, specialized NPS software makes sending event-based surveys to customers quick and simple.

Relationship NPS is ideal for looking into how your customers view your business over the long term. Since you’ll have multiple data points, you can track long-term progress and changes in customer sentiment and perception.

How to Use Transactional Survey Data

We’ve written extensively on how to use relationship NPS data effectively, from timing your surveys properly to assessing your company’s Net Promoter Score against benchmarks.

However, transactional NPS is a completely different ball game, with new rules, best practices and tactics.

As a general rule, it’s best to focus on transactional surveys when you have a large number of customers, each of whom spends relatively on your products and services. In this situation, a customer’s reaction to a transaction is more important than their relationship with your brand.

This means a B2C business with a $50 product is more likely to benefit from transactional NPS than a B2B agency that sells $10,000 per month of professional services.

Transactional NPS is also best used when you need specific information about a new product, service or offer. Since relationship NPS is all about long-term customer sentiment analysis, it rarely produces any meaningful transaction-specific insights.

While running both NPS methods, you risk over-surveying your clients. Focus on infrequent surveying — once per quarter, at most, for relationship NPS, and once for every large purchase for transactional NPS data — and you’ll get the best mix of frequency and data quality.

Best Practices for Using Transactional NPS Surveys:

- Identify Your Touchpoints: Choose the touchpoints that provide the most value, such as in-store purchases, online transactions, or customer service interactions. Prioritize those that directly impact customer satisfaction and loyalty.

- Select Effective Distribution Channels: Simplify survey distribution by choosing the most convenient channels for your customers, such as email, SMS, QR codes, kiosks, or in-app feedback. These should align with customer preferences and behavior.

- Design Your Transactional NPS Survey: Structure your survey to include a standard NPS question and a follow-up question to understand the reasons behind the scores.

- Analyze & Act on Feedback: Use both absolute and relative methods to calculate your NPS score. Benchmark it against industry standards to assess performance and understand your position relative to competitors. More importantly, close the feedback loop by addressing flagged issues while proving your commitment to customer satisfaction.

Collect Transactional and Relationship NPS

Some businesses benefit from a focus on transactional NPS, while others on relationship NPS. Some brands, particularly those that sell products and services to the same customers over time, benefit most from combining the two forms of feedback.

For instance, Amazon combines transactional and relational NPS to get a complete picture of customer satisfaction. They gather immediate feedback post-delivery with transactional NPS and assess long-term brand sentiment via relational NPS. This strategic approach helped Amazon achieve the top position for value and selection in the 2023 American Customer Satisfaction Index (ACSI).

No matter what type of feedback your business values most, you’ll find it faster and easier to survey your customers, generate actionable insights and calculate your Net Promoter Score using Retently.

Greg Raileanu

Greg Raileanu

Alex Bitca

Alex Bitca

Christina Sol

Christina Sol